Zong, being one of the main telecom operators in Pakistan, offers an important document called the Zong Tax Certificate. This document is important for people and agencies alike, as it information the tax deducted from your telecom fees. It is essential for filing tax returns, making sure that you are at the proper side of the law.This comprehensive manual is tailored to walk you through the whole manner of acquiring your Zong Tax Certificate. From knowledge of what it's far, why you want it, and a way to get it - we’ve been given you covered.

Table Of Content

- Understanding Zong Tax Certificate

- Documents Required For Zong Tax Certificate

- Step-By-Step Guide To Getting Your Zong Tax Certificate

- How To Get Your Zong Tax Certificate By Visiting A Zong Franchise

- How To Use Your Zong Tax Certificate

- Frequently Asked Questions

Understanding Zong Tax Certificate

What is a Zong Tax Certificate?

A Zong Tax Certificate is an legit report issued by way of Zong, which gives an in depth breakdown of the tax deducted out of your cellular smartphone utilisation and other Zong offerings over a specific length.

Why Do You Need It?

Obtaining these certificates is not only a legal requirement; it additionally allows you to claim tax credit, making sure that you aren't overpaying in your tax dues..Zong tax certificates reflect the different types of taxes that are paid in Pakistan. It serves as a proof of your tax deductions and is necessary when filing your annual tax returns.

Documents Required For Zong Tax Certificate

Certainly, here are the essential documents required to gain a Zong Tax Certificate:

- A Valid Computerised National Identity Card (CNIC): This is needed to verify your identity. Make positive that your CNIC is not expired and clearly shows your image and all vital details.

- Zong Mobile Number: You will need to provide the Zong cell variety that is registered below your CNIC. This is crucial for retrieving the tax statistics unique to your account.

- A Recent Zong Mobile Bill: This is needed to verify that you are an energetic subscriber of Zong services. Ensure that the bill is current, preferably from the closing month.

- Account ID or Customer Number: This is a completely unique identifier provided via Zong when you first of all registered for their services. It can usually be found on your cell invoice.

- A Verified Email Address: You will need to offer an email deal with where Zong can ship the tax certificate once it is prepared for download. Ensure that this electronic mail is lively and accessible.

- Details of the Specific Time Period: Be geared up to offer specific details regarding the time period for which you require the tax certificate. This is normally the economic yr for that you are filing a tax return.

- Any Previous Tax Certificates (If Applicable): If you have implemented for and acquired a Zong Tax Certificate inside the past, it is probably beneficial to have it handy in case any reference is required.

Ensuring you have got a lot of these documents prepared and accessible will assist in dashing up the system of acquiring your Zong Tax Certificate.

Step-By-Step Guide To Getting Your Zong Tax Certificate

If you are a Zong prepaid or postpaid user in search of your yearly tax-paid proof, you are in luck! Now, it's possible to acquire your tax certificate & check tax filer status from the comfort of your own home without the need to visit a franchise or customer care centre. Below, we present a detailed, step-by-step guide on how to obtain your Zong Tax Certificate through three different methods:

1. Zong E-Care Portal

The Zong E-Care portal is a user-friendly platform designed specifically to facilitate important downloads for both prepaid and postpaid users.

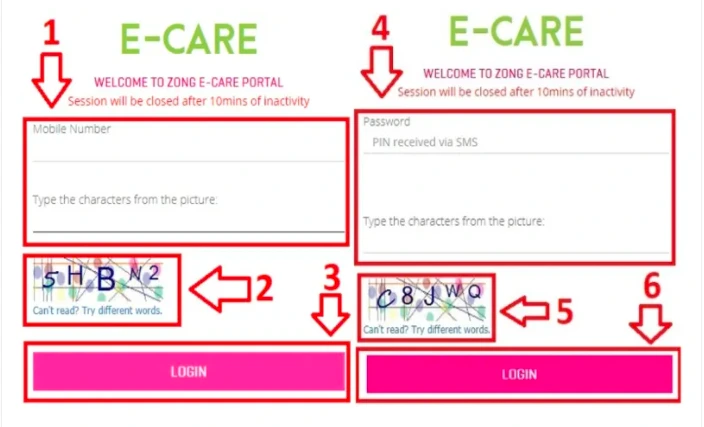

-

Visit the E-Care Portal: Open your browser and navigate to Zong

E-Care Portal.

- Enter Your Zong SIM Number: Type in your Zong SIM number in the provided field.

- Complete the Security Check: Enter the required characters in the second box for verification purposes.

-

Log In: Click on the “LogIn” button to access your account. A

verification code will be sent to your Zong number.

- Enter Verification Code: Input the received code on the next page to proceed.

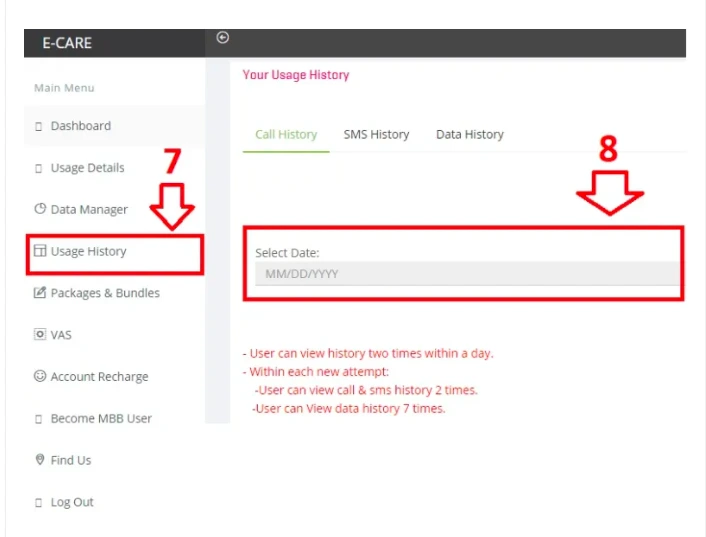

- Navigate to Usage History: Once logged in, select “Usage History” from the available options on the right side of the page.

- Enter Required Dates: Specify the Month, Date, and Year to generate your Zong Tax Certificate.

- Download the Certificate: After inputting the dates, your tax statement will appear, ready for download.

By following these steps, you should be able to successfully download your Zong Tax Certificate through the E-Care portal.

2. My Zong App

The "My Zong App" is a convenient option for obtaining your Zong Tax Certificate directly from your smartphone.

-

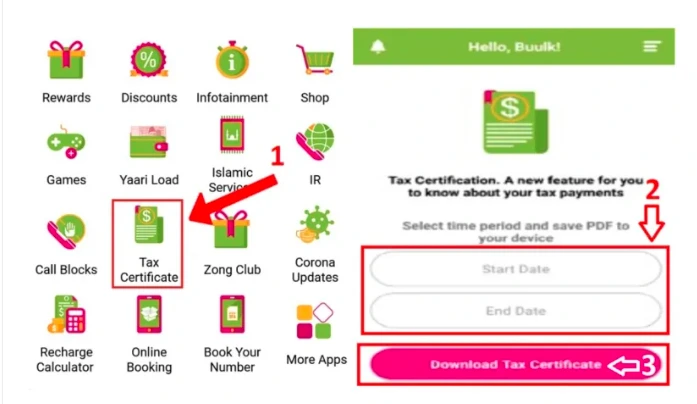

Download the App: If you haven’t already, download and install

the “My Zong App” from your device's app store.

- Open the App: Launch the app and navigate through the options on the front page.

- Select ‘Tax Certificate’: Find and click on the “Tax Certificate” option.

- Input the Dates: Enter the “Start Date” and “End Date” for the duration of the certificate you require.

- Download the Certificate: Click on the “Download Tax Certificate” button and wait for the certificate to download.

3. Official Zong Email

Although this method is less popular and reliable, you can still request your tax certificate via email.

- Compose an Email: Open your email client and compose a new email.

- Address the Email: Send the email to Zong’s official customer service email address.

- Specify Your Request: Clearly state your request for a tax certificate, including the required duration and your Zong number.

- Send the Email: Once you've composed your email, send it off and wait for a response from Zong’s customer service team.

- Note: We recommend using the Zong E-Care portal or My Zong App for a quicker and more reliable service.

By following these detailed guides, you should be able to obtain your Zong Tax Certificate with ease, choosing the method that best suits your preferences.

How To Get Your Zong Tax Certificate By Visiting A Zong Franchise

If you prefer to get your Zong tax certificate in person, you can visit your nearest Zong franchise. The staff at the franchise will be able to help you download the certificate and provide you with any additional information you may need.

How To Use Your Zong Tax Certificate

To use your Zong tax certificates, you will need to attach it in your income tax return whilst you record it. The withholding tax that Zong has deducted from your cell smartphone invoice will then be credited on your tax account, and you'll be able to declare a refund in case you are eligible.

<Frequently Asked Questions

Q: Who desires a Zong tax certificate?

A: Anyone who files profits tax in Pakistan needs a Zong tax certificate. This consists of individuals, businesses, and different companies.

Q: How can I get my Zong tax certificate?

A: You can get your Zong tax certificates on-line or by means of visiting a Zong franchise.

Q: How do I get my Zong tax certificates with the aid of touring a Zong franchise?

A: To get your Zong tax certificates by joining a Zong franchise, honestly go to your nearest franchise and ask the staff for help. They can be capable of helping you download the certificate and offer you with any extra facts you may need.

Q: What do I need to do with my Zong tax certificates?

A: You must connect your Zong tax certificate on your profits tax return when you record it. The withholding tax that Zong has deducted from your mobile cellphone invoice will then be credited to your tax account, and you will be capable of declaring a refund in case you are eligible.

Q: What if I even have lost my Zong tax certificates?

A: If you have lost your Zong tax certificate, you may download a new one from the Zong e-Care internet site or the My Zong app. You can also get brand new certificates through journeying through a Zong franchise.

Q: Do I need to pay a charge to get my Zong tax certificate?

A: No, there may be no charge to get your Zong tax certificate.

Q: What is the deadline for submitting my earnings tax return?

A: The cut-off date for filing your income tax return in Pakistan is December 31st of every 12 months.