An NTN, or National Tax Number, is issued to individuals and businesses in Pakistan who are required to file taxes or choose to register for tax purposes. It is typically a seven-digit number, though it may vary in length depending on the type of taxpayer. The Federal Board of Revenue, which is in charge of managing and collecting taxes in Pakistan, conducts the online NTN verification process. You must visit their website and provide your CNIC number along with a few other pieces of information in order to authenticate your NTN.

Every individual who is willing to earn in Pakistan can no doubt be eligible to pay tax. Being a Pakistani citizen it is the most important responsibility to pay taxes on time. Meanwhile, it is equally important to pay it in the right way. To register as a legal taxpayer, you must have an NTN number.

Table Of Content

How to Check NTN Number from CNIC in Pakistan

To check your NTN number online using your CNIC number, follow these simple steps:

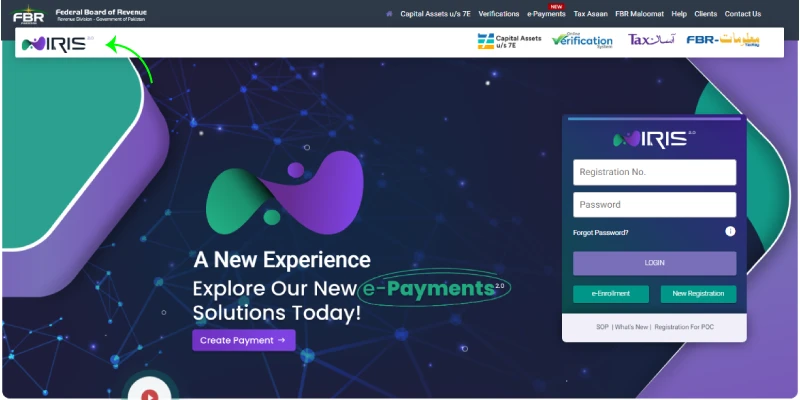

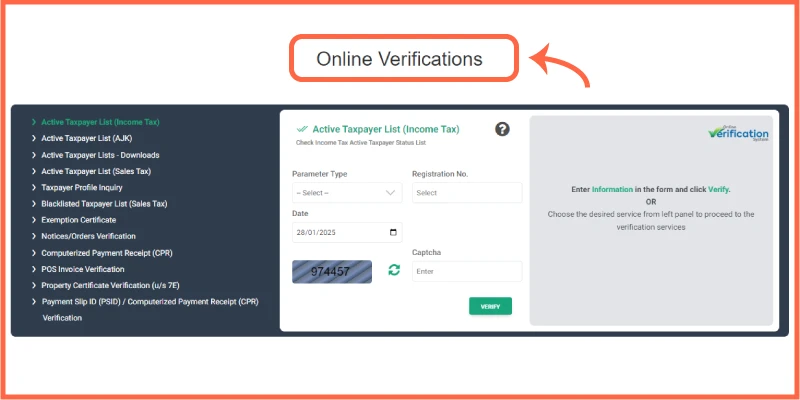

- Visit IRIS 2.0 or FBR Online Verifications.

- Scroll down to the "Online Verification" section.

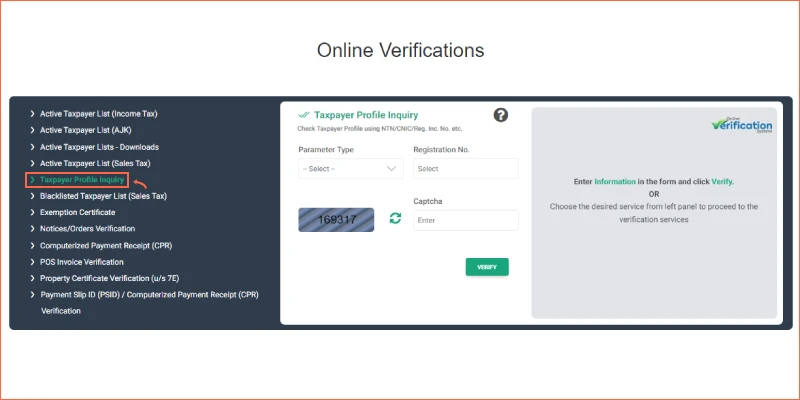

- From the left sidebar, select the “Taxpayer Profile Inquiry” option.

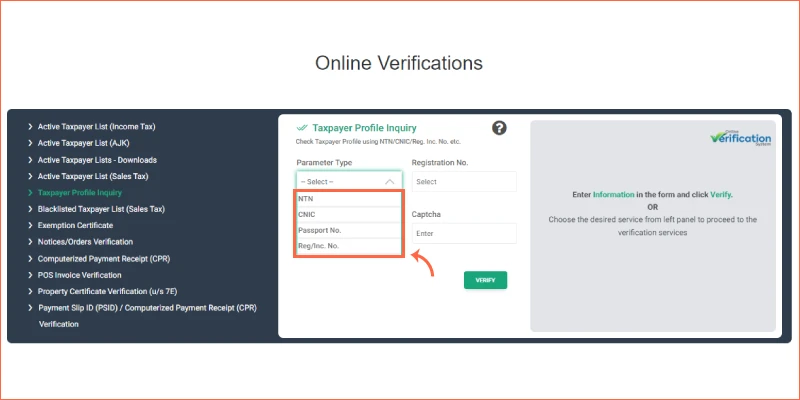

- Choose the relevant option from the "Parameter Type" drop-down menu.

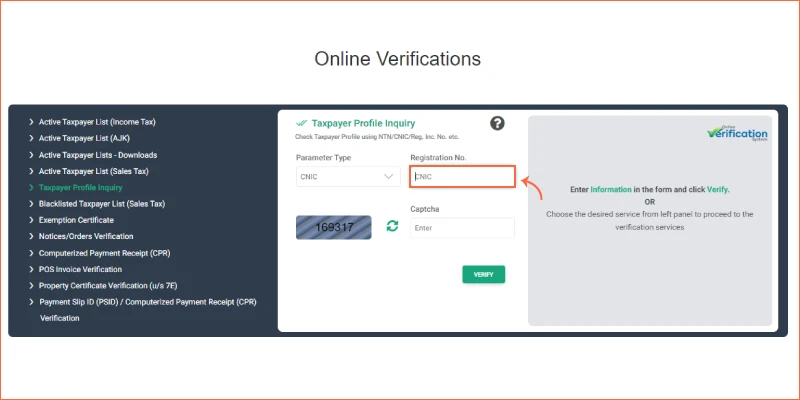

- Enter your CNIC number in the provided field.

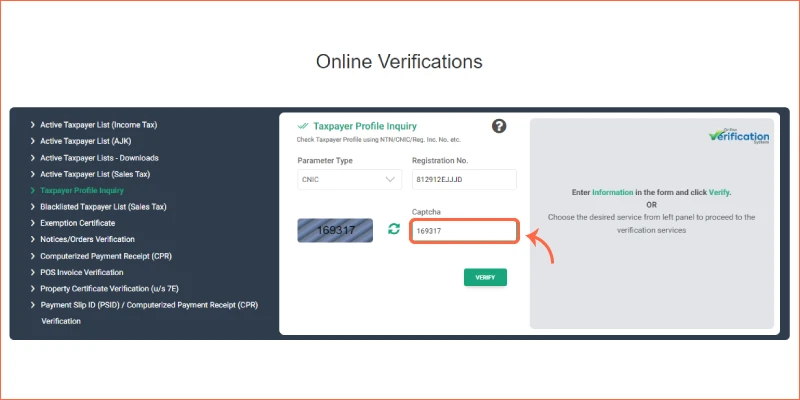

- Complete the captcha verification.

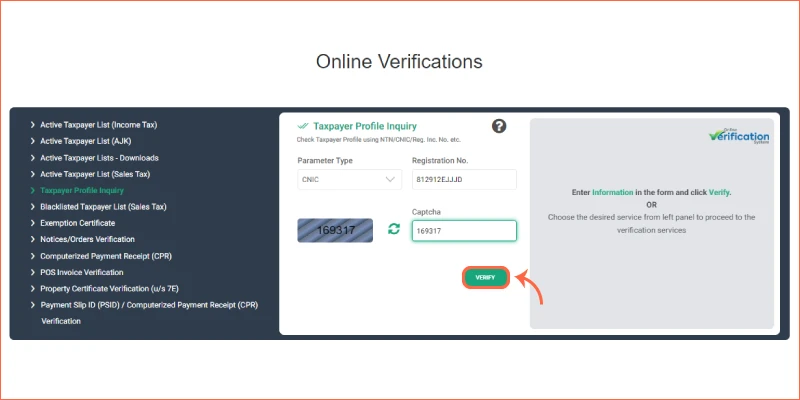

- Click the “Submit” button.

- The system will display the taxpayer’s details, including the NTN number (listed as the Reference Number), RTO, and personal information linked with the NTN.

How To Get NTN Number From FBR?

You can now easily get your National Tax Number (NTN) from FBR as the process is almost online nowadays. It's not compulsory to visit the Federal Board of Revenue office to get your National Tax Number. If your income is taxable then you have to get NTN from FBR. If your yearly income is 6 lacs then you are liable to pay income tax.

Now FBR has linked the system with NADRA’s database so that online verification of CNIC provided can be done.To get your NTN, follow these simple steps and provide the required documents.

Required Information and Documents:

- Valid Computerized National Identity Card Number (CNIC).

- Mobile number registered in your name.

- Valid email address.

- Scanned copies of documents.

- During the registration process, you will receive a verification code via SMS and email. Enter these codes, and once they are confirmed, you will receive your login ID and password.

- Using the login credentials, fill out the application form under section 181. You will need to upload scanned copies of required documents, such as property details, business information, and bank account details.

- After submitting the form, your NTN number will be issued within an hour. The submitted form will be your official NTN for all purposes.

Steps To Getting National Tax Number(NTN)

Step 1: Start by visiting the official FBR website.

Step 2: If you have not yet registered, avail the registration option.

Step 3: A form will be loaded asking for following information:

- CNIC

- Name

- Contact numbe

- Address

- Email address

Fill all of these correctly.

Step 4: After completing , make sure you have provided the right information and submit. A code will be sent to your contacts.

Step 5: Enter the code correctly and use received passwords and User ID to log in.

Step 6: After logging into your account you will see drafts.

Step 7: Click on edit, you will find following tabs.

- Personal Tab

- Business Tab

- Property Tab

- Link Tab

- Attachment

- Bank Account tab.

Step 8 : Fill out the necessary fields in each tab. For salaried individuals, you will need to enter your employer's NTN in the Link tab. For most individuals, you may not need to provide information in the Business or Bank Account tabs unless applicable.

Step 9 : Make sure to attach the necessary scanned documents as per the requirements.

Step 10 : Once everything is filled out and checked, click on Submit. After submission, you will receive your NTN number within an hour. The submitted form will be considered your NTN for all official purposes.

By following these steps, you can easily register for an NTN online through the FBR system and start filing your taxes.

Read More: Filer Vs Non-Filer - A Comprehensive Guide

Types of NTN Registration Available Online

NTN holders in Pakistan have the responsibility to file their annual income tax returns with the Federal Board of Revenue (FBR) within the designated deadlines. For individuals with an NTN, the last date to file returns is typically 30th September each year. However, for companies, the deadline varies based on the company's financial year-end, with return filing due at the end of September or December.

In Pakistan, there are three main types of online NTN, each serving different categories of taxpayers.

1. Personal NTN

Personal NTN is issued by the FBR based on the CNIC of an individual. It applies to both salaried individuals and those engaged in business activities. After registering for an NTN, a taxpayer can also add their sole proprietorship business to their FBR profile, allowing them to manage their personal and business tax information in one place. You can verify your personal NTN through the FBR’s online NTN verification system.

2. Association of Persons (AOP) / Partnership NTN:

An AOP or partnership NTN is issued to a collective of individuals who form a partnership. This type of NTN is specifically for businesses that involve at least two partners. If you're part of a partnership, you can check the AOP or partnership NTN via the FBR's online NTN inquiry tool.

3. Company’s NTN

This type of NTN is assigned to companies, which are registered with the Securities and Exchange Commission of Pakistan (SECP). Companies can check their NTN online by entering their Incorporation or Company Registration Number, which is issued during the company's registration process with SECP.

Online NTN Certificate

To streamline tax registration and services, the FBR offers an online NTN certificate procedure. This allows taxpayers to apply for their NTN certificate without having to visit physical locations.

Here’s how you can get your NTN certificate online:

- Go to www.e.fbr.gov.pk and select "New e-registration" from the dropdown menu under "e-Registration".

- Depending on your taxpayer type (Individual, AOP, or Company), fill in the registration form with your CNIC, NTN, or Registration/Incorporation number and enter the image character to proceed.

- Once you have completed the form, click "Verify" to ensure all information is accurate. After verification, submit the form and note the system-generated token number for future reference.

- After submitting your application, the FBR system will send you an email confirming your NTN registration. The verification process typically takes around 3 working days.

- After your application is approved, you can collect your NTN certificate by visiting a TFC center and presenting the signed registration application along with the required documents.

Read More: How To Check Online NTN Verification By CNIC In Pakistan

Documents Required For Salaried Persons NTN Registration

If you are a salaried person then the required documents are given below;

- CNIC copy

- Paid electricity bill of the house (not older than 3 months).

- Latest payslip.

- Valid Contact Numbers & Email address

- National Tax Number (NTN) of Employer, Office Address, and valid Email address

Documents Required For Business NTN Registration

If you are a businessman then the required documents are given below;

- CNIC copy

- Paid electricity bill of business location(last 3 months).

- Blank Business Letter Head.

- Property papers or Rental Agreement(Rental Agreement printed on Rs. 200/- stamp paper).

- Contact Numbers & Email address.

- Business Nature.

Why Do You Require A National Tax Number (NTN)?

In Pakistan, obtaining a National Tax Number (NTN) is a legal requirement set by the Federal Board of Revenue (FBR). It is mandatory for both salaried individuals and entrepreneurs to ensure timely payment of taxes. To fulfill this obligation, you must register for an NTN, which will be officially authorized by the FBR.

Key Benefits of Having an NTN:

- Reduced vehicle token tax rates

- Lower tax rates on banking transactions

- Reduced taxes on property transactions, and more.

Having an NTN, not only ensures compliance with the law but also provides several tax-related benefits that can help you save money and simplify your financial dealings.

Need Help with NTN Registration?

If you need any assistance or have questions about the registration process, our team at Tax Consultancy is here to help. We provide expert guidance to make your tax journey hassle-free.

For professional assistance and expert guidance on tax matters, get in touch with our Top Tax Consultants today. We're here to simplify your tax journey and ensure compliance with ease.