If you're a taxpayer in Pakistan, having a National Tax Number (NTN) is essential for legal financial activities. Whether you're an individual or a business, the Federal Board of Revenue (FBR) issues this number to track your tax obligations. Checking your NTN online using your CNIC is a simple process that can be done directly through the FBR's portal. Here's a detailed guide on how to do it.

Table Of Content

- Step-by-Step Guide To Check NTN Online Using CNIC

- Types Of NTNs In Pakistan

- Important Deadlines For NTN Holders

- Why Keeping Your NTN Information Safe Matters

- Conclusion

Step-by-Step Guide To Check NTN Online Using CNIC

-

Visit FBR's Official Website:

-

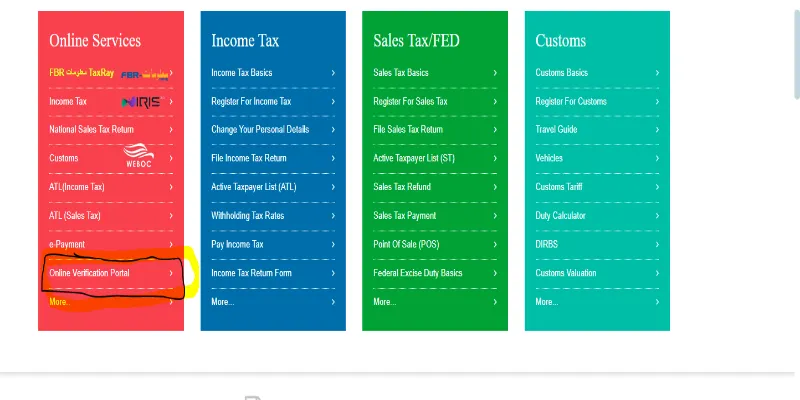

Open the official FBR portal at e.fbr.gov.pk.

-

Scroll down until you find the "Online Verifications" section.

-

-

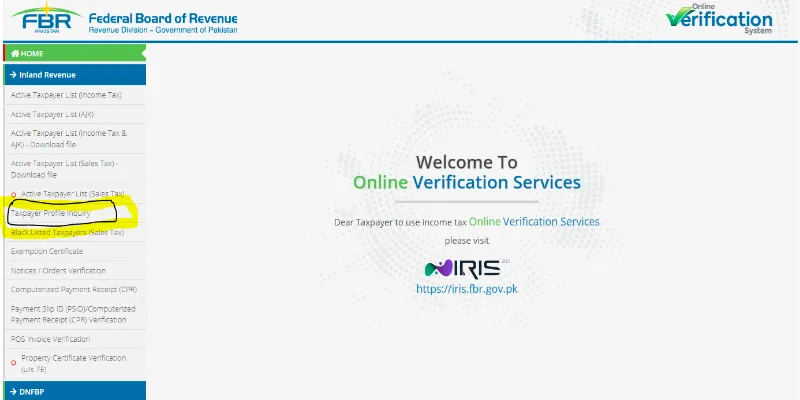

Select "Taxpayer Profile Inquiry":

-

Click "Taxpayer Profile Inquiry" in the left sidebar to begin the verification process.

-

-

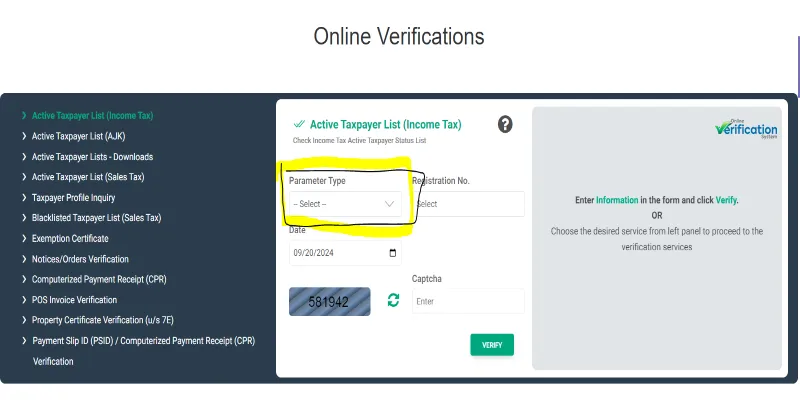

Choose Your Parameter Type:

-

From the drop-down menu labeled "Parameter Type," select "CNIC" if you're verifying as an individual.

-

-

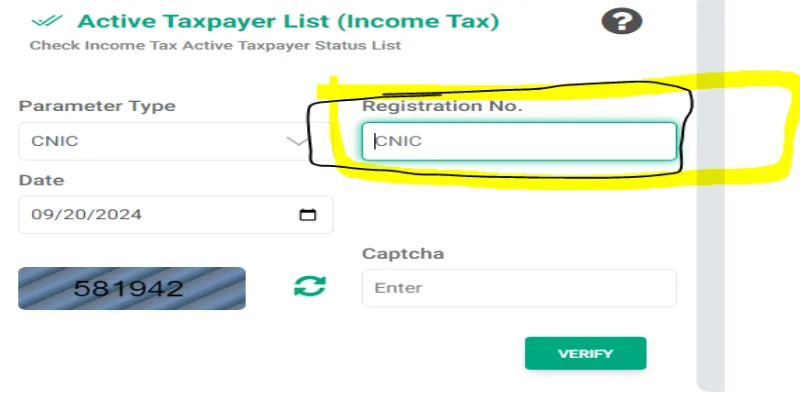

Enter Your CNIC:

-

Input your 13-digit CNIC number without dashes in the provided field.

-

-

Captcha Verification:

-

Complete the Captcha to verify that you're not a bot.

-

-

Submit Your Information:

-

After filling in the details, click "Submit." If your details are correct, the system will display your NTN information, including personal details, registration details, and associated RTO (Regional Tax Office).

-

-

Additional Details:

-

If you are not registered, the system will guide you through the steps to apply for an NTN using the "Registration for Unregistered Person" option.

-

Types Of NTNs In Pakistan

FBR issues different types of NTNs based on the taxpayer's profile:

- Personal NTN: Issued to individuals where the CNIC serves as the NTN. This is typically for salaried employees or sole proprietors.

- Association of Persons (AOP) / Partnership NTN: Issued to partnerships or associations of at least two individuals. This can also be verified through the FBR's online portal.

- Company NTN: For registered companies, the NTN is provided by the FBR upon incorporation. It can be checked using the company's registration number.

Important Deadlines For NTN Holders

NTN holders must file their income tax returns annually. The deadline for individuals is September 30th each year. For companies, the deadline can vary based on their fiscal year-end, typically in September or December.

Why Keeping Your NTN Information Safe Matters

Your NTN is linked to your financial and Tax obligations. Keeping it secure prevents interruptions in financial transactions and tax filings. Misplacing it or failing to keep track of your tax obligations can result in penalties or legal complications.

Conclusion

Verifying your NTN online using your CNIC is quick and convenient, thanks to FBR's streamlined online services. Whether you're an individual, part of a partnership, or running a company, keeping track of your NTN status ensures smooth compliance with Pakistan's tax regulations.

Always ensure your CNIC and NTN details are up to date and secure for easy access during tax filing seasons. For any assistance or further guidance,tax consultancy is always here to help you navigate the complexities of tax matters. Our experts provide personalized services to ensure your tax filing process is seamless and hassle-free.