Navigating the world of mobile taxation can seem like a maze, but it's easy once you get the hang of it—especially the taxes levied by Pakistan's Telecommunication Authority (PTA). So, what's the PTA mobile tax all about? Simply put, it's the tax you pay when you bring a mobile phone into Pakistan or purchase one within the country.

But why should you keep a tab on PTA mobile taxes? Well, it's not just about staying on the right side of the law; it's also about knowing what extra charges might pop up on your mobile purchase. Plus, checking these taxes can help you plan your budget smarter.

Ready to check PTA mobile taxes? You're in luck because it's straightforward. With a few clicks online or a quick check via SMS, you can get all the tax info you need. And don't worry; taxconsultancy got your back with a step-by-step guide that's as easy as pie, keeping you informed. Let’s dive in and demystify the process, making sure you're all clued up on your mobile taxes!

Table Of Content

- Understanding Mobile Tax In Detail

- Step By Step Process To Check Mobile TAX

- Additional Information: Checking PTA TAX Status Via SMS

- How To Calculate PTA Tax Fee 2023

- Conclusion

Understanding Mobile Tax In Detail

What is Mobile Tax & Why Is It Important?

Mobile tax refers to the levy imposed by a government on the sale, purchase, or usage of mobile devices and services. It's a way for the state to tap into the strong telecommunications market, ensuring that as mobiles become nearly as essential as basic utilities, they contribute their share to the national coffers and often also pay zong tax certificates. Mobile tax plays a crucial role in the fiscal landscape for several reasons:

- Ensures everyone with a mobile device contributes fairly to the state’s resources.

- By taxing mobiles, it helps to regulate the industry, maintaining balance between demand and supply.

- Taxes from mobiles can be reinvested, potentially boosting economic growth.

- It provides financial support for the governance necessary to maintain the mobile communication networks.

- Aims to distribute the tax burden equitably among different income groups.

Step By Step Process To Check Mobile TAX

Certainly! When you have checked the PTA tax amount, you can also learn How to Pay PTA Tax Below is the improved and unique step-by-step guide on how to check mobile taxes with PTA , integrating the provided competitor's information:

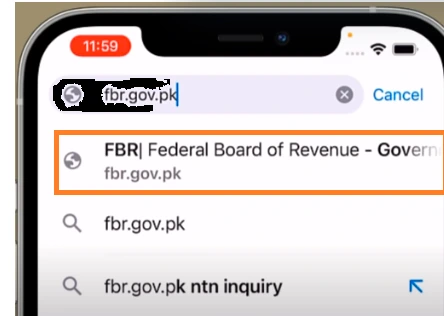

Step 1: Navigate to the Official FBR Website

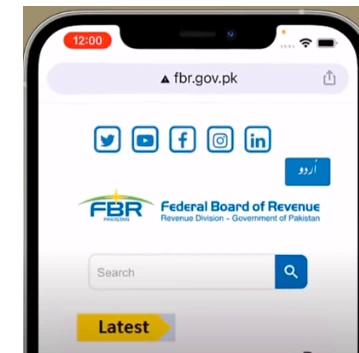

First step is to open your preferred web browser on any device, be it a mobile, iPhone, or computer. Punch in ‘fbr.gov.pk’ into the address bar and hit enter. You’ll be whisked away to the Federal Board of Revenue’s official platform—a key player in the tax game. Simple, quick, and your first move towards tax clarity.

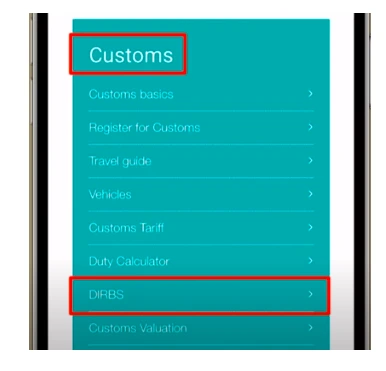

Step 2: Locate the CUSTOMS Section

When you go to the FBR homepage, carefully scroll down until you reach the end of the CUSTOMS section. Here, you will find and select a channel labelled ‘DIRBS’ to proceed.

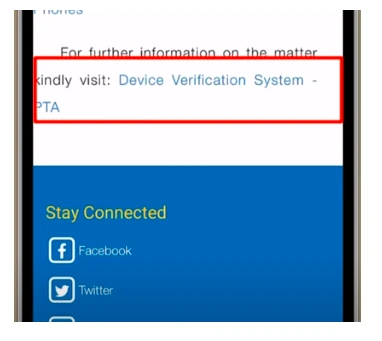

Step 3: Access the Device Verification System PTA

As you enter the DIRBS section, scroll down the page. There you will find a link to the ‘Device Verification System PTA’. Click on this link to continue to the next step.

Step 4: Navigate to the PTA Linked Portal Website

Clicking on the link mentioned above will redirect you to the PTA Linked Portal website, which is specifically designed for equipment review and TAX status analysis.

Step 5: Find the "Check Your Device Status" Option

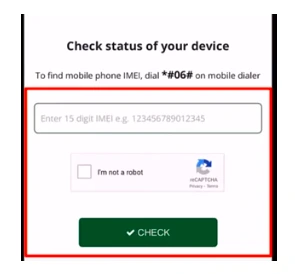

Once you're on the portal, ease down the page until you spot the 'Check your device status' section. Here's where the magic happens: you'll get to know where your mobile stands with PTA. Just type in the details it asks for—no sweat, just a few taps and clicks. Simple, right?

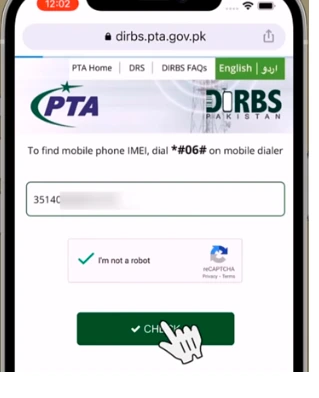

Step 6: Enter Your Device’s IMEI Number

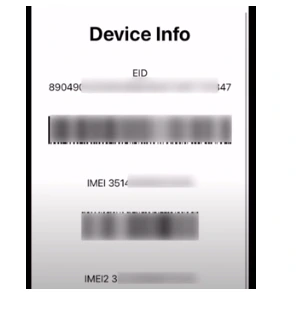

Next up, it's time to dig out your device’s IMEI number. This unique code is like your phone's fingerprint, and all it takes to find it is a simple code. Punch in *#06# on your phone's dial pad, and the 15-digit number will pop up. Jot it down precisely — it’s crucial. If your phone is a solo SIM runner, it'll have one IMEI; the two-timer dual-SIM ones carry a pair. Keep that number handy for the next step!

Step 7: Submit the IMEI Number

Now, take the IMEI number(s) that flashed up on your screen and carefully transfer them into the 'Check your device status' box on the portal. Accuracy is key here—double-check to ensure every digit is in its rightful place, with no slip-ups. It’s a small step, but it’s the heart of the matter, so let’s get it spot on.

Step 8: Complete the Verification and Check

Once you've input the IMEI number(s), there's a little tick box that's all about proving you're human – give it a check for the captcha challenge. All set? Now, hit the ‘Check’ button to send your details through. It's just like dropping a letter in the mailbox, waiting for the reply to land.

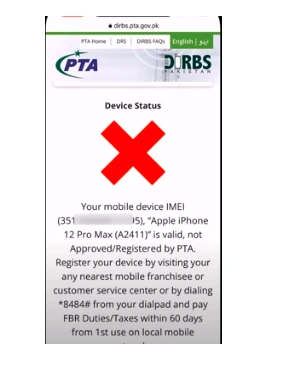

Step 9: Review the Mobile Status

On the following screen, the tax status of your mobile by PTA springs to life. Devices like PTCL invoice in the clear will flaunt a reassuring green line, while the ones not making the cut will flash a stern red cross. Keep an eye out for what shows up; it's the signal you need to know your device's standing.

Additional Information: Checking PTA TAX Status Via SMS

| Step Number | Action | Friendly Tip |

|---|---|---|

| 1 | Dial *#06# on your mobile | This nifty code quickly shows your phone’s IMEI number. Make sure to jot it down! |

| 2 | Send the 15-digit IMEI number to 8484 | Just like sending a regular SMS. Easy, right? |

| 3 | Wait for a response | You’ll receive a text with all the details about your phone’s TAX status. Sit tight, it’ll arrive shortly! |

Read More about Do Commercial Renters Pay Property Tax?

How To Calculate PTA Tax Fee 2023

To pinpoint your mobile's worth, grab a calculator and head over to the manufacturer's website or check with the retailer you're buying from. Once you’ve got the figures, match your phone's price with the PTA tax slab it falls under.

These slabs vary, resting on how much your phone taps the scales at, as laid out in the table you'll find below.

| PTA Tax Slab | Value of Mobile Phone | PTA Tax Fee (Passport Holder) | PTA Tax Fee (CNIC Holder) |

|---|---|---|---|

| Slab 1 | $100-$200 | Rs. 25,000 | Rs. 30,000 |

| Slab 2 | $201-$300 | Rs. 35,000 | Rs. 40,000 |

| Slab 3 | $301-$400 | Rs. 45,000 | Rs. 50,000 |

| Slab 4 | $401-$500 | Rs. 55,000 | Rs. 60,000 |

| Slab 5 | $501-$700 | Rs. 72,500 | Rs. 85,500 |

| Slab 6 | $701 and above | Rs. 107,325 | Rs. 130,708 |

Calculate the PTA tax fee by multiplying the value of your mobile phone by the applicable PTA tax rate.

For example, if you are purchasing an affordable mobile phone worth $350 and you are a passport holder, the PTA tax fee will be Rs. 35,000.

Conclusion

In wrapping up, checking your mobile's tax status with PTA is no steep mountain to climb. It's a straightforward journey, stepping from the FBR portal to the tax slab tables. Whether your device shines with approval or needs a bit more attention, you’re now equipped to navigate this landscape. Remember, TaxConsultancy is always here to steer you through the maze of mobile taxation with ease. With the knowledge you've gained, you're set to keep your mobile adventures both smart and compliant. So go ahead, check those taxes, and stay connected without a hitch!