Have you ever stumbled upon your tax documents and wondered how to get your PTCL tax certification in Pakistan? Maybe it's that time of the year when you’re trying to straighten out your tax affairs, and this particular document is giving you a headache. Tax matters, especially in Pakistan, can be intricate, but there's a way to make this process smoother. This guide is tailored for individuals like you, who want a straightforward path to obtaining their PTCL annual return. Keep reading, and by the end of this blog, you'll be well-equipped to handle this with ease.

Table Of Content

- Brief Overview of PTCL (Pakistan Telecommunication Company Limited)

- Requirements For Acquiring The Tax Certification

- A Step-by-Step Guide To Getting Your PTCL Withholding Invoice

- Why Do You Need a PTCL Tax Document?

- Common Mistakes To Avoid

- The Validity And Duration Of The PTCL Tax Document

- Tips For Safe Storage Of Your PTCL Tax Proofs

Brief Overview of PTCL (Pakistan Telecommunication Company Limited)

Pakistan Telecommunication Company Limited (PTCL) stands as the primary telecommunication authority in Pakistan. With its roots tracing back to the pre-independence era, PTCL has evolved into a modern, tech-savvy corporation catering to millions across the country.As with any major service provider, PTCL is under the obligation to maintain transparency in its financial dealings. The tax document stands as a beacon of this commitment, ensuring every rupee's accountability.A PTCL Tax page is paramount for:

- Proof of tax deductions related to PTCL services.

- Filing annual income tax returns.

- Transparent financial and tax record maintenance.

Requirements For Acquiring The Tax Certification

| Requirement | Description |

|---|---|

| Authentic ID Card (CNIC) | For identity verification. |

| Recent PTCL Bill | To confirm you're an active PTCL subscriber. |

| Proof of Past Payments | Validates your financial integrity with PTCL. |

Once your application is submitted, PTCL doesn’t simply stamp it approved. A meticulous verification ensures that your records align with PTCL's databases.

A Step-by-Step Guide To Getting Your PTCL Withholding Invoice

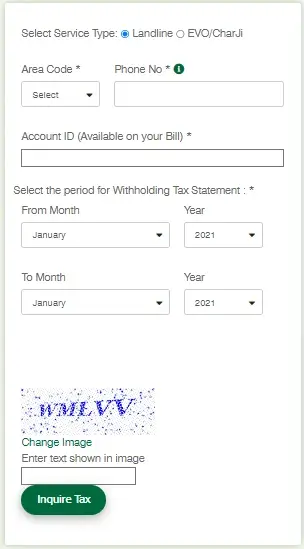

Step 1: Access the Official PTCL Website https://ptcl.com.pk/CustomerTax/TaxInquiry

Firstly, open your preferred web browser and type in the URL or simply click on: Official PTCL Website. This will lead you directly to the Tax document inquiry page of PTCL.

Step 2: Choose Your Service Type

Upon landing on the webpage, you'll notice a dropdown menu titled 'Service Type.' Click on this menu and select 'Landline' from the available options.

Step 3: Input the PTCL Area Code

Below the service type, there's another dropdown menu for 'Area Code.' Select your specific PTCL area code from the dropdown list. For example, if you're from Karachi, you'll choose '021.'

Step 4: Enter Your Phone Number

In the next input box, type in your complete PTCL phone number. It should follow this format: 021-1234567890. Ensure that you include the hyphen after the area code.

Step 5: Input the Account ID

This is a crucial step. You'll need to enter the specific Account ID associated with your PTCL number. This ID is usually found on your monthly PTCL bill. It's a unique number provided by PTCL to each customer.

Step 6: Select the Desired Period

You'll notice an option titled 'Period.' Click on it to select the timeframe for which you want the tax document. This could be monthly, quarterly, or annually, depending on your preference.

Step 7: Solve the Captcha

For security purposes, there's a captcha box. This is to ensure that the request is being made by a human and not by automated bots. Follow the captcha instructions and input the characters or numbers you see in the provided box.

Step 8: Initiate the Inquiry

Once all details are correctly filled in, click on the 'Inquire Tax' button. The system will then process your request.

Step 9: Download Your Tax Document

If all the details match PTCL's records, you'll be redirected to a new page. Here, your PTCL Tax document will be displayed, ready for download. Click on the 'Download' or 'Print' button to save the certificate on your device or print it out.

Why Do You Need a PTCL Tax Document?

This certificate isn’t a mere piece of paper. It’s proof! It assures you and others that you've fulfilled all your financial obligations related to PTCL. Crucial for:

- Ensuring smooth tax returns.

- Keeping your business operations transparent.

- Garnering trust during financial dealings, such as loan acquisitions.

Common Mistakes To Avoid

A Stitch in Time : Delaying your application? This is the first pitfall. Mark your calendar, set reminders but avoid procrastination.

Details, Details, Details! : Input errors, a mismatch of details, or outdated information? These can be roadblocks. Double, even triple-check your inputs.

Renewal Woes : Tax documents have a shelf-life. Overlooking renewal deadlines could land you in hot water. Stay ahead.

The Validity And Duration Of The PTCL Tax Document

| Topic | Details |

|---|---|

| Validity Period | Annual – Typically covers one fiscal year. |

| Importance of Specific Dates | Always refer to the "valid from" and "valid to" dates on the certificate. |

| Reason for Set Duration | Ensures tax records are up-to-date, reflecting the most recent payments and deductions. |

| When to Renew | As the certificate approaches its expiration. Renew close to the expiration date for a continuous record. |

| Utility | Handy during tax filing seasons and for official financial verifications. |

Tips For Safe Storage Of Your PTCL Tax Proofs

In the realm of financial accountability and taxation, documents play a pivotal role. One such document, especially for the people of Pakistan, is the PTCL Tax document. Without it, you aren't merely missing a piece of paper; you're potentially putting yourself at risk in the legal and financial arena. Let’s delve deeper into the repercussions of not possessing this essential certificate.

Legal Disputes with Tax Authorities: The absence of a PTCL Tax Certification can raise red flags with the tax authorities. This document is a testament to the fact that you've fulfilled your telecommunication tax obligations. Without it, you may be viewed with suspicion, which could trigger unnecessary legal battles or inquiries. Such legal entanglements not only drain resources but also consume valuable time.

Potential Fines or Penalties: In the world of taxation, every unaccounted cent can be consequential. If you're unable to produce a PTCL Tax Certification when demanded, you might be subjected to hefty fines. The rationale? From the authorities' viewpoint, no certificate could mean unaccounted tax, warranting punitive measures.

Difficulty During Tax Consultancy: Picture this: you're meeting with a tax consultant, trying to streamline your finances, and the topic of telecommunication tax arises. If you lack the PTCL Tax document, your consultant might find it challenging to authenticate your tax history. This not only hampers the efficiency of the tax consultancy process but also can cast shadows of doubt on your financial transparency.

As we navigate the maze of taxation in Pakistan, the PTCL Tax document emerges as a vital tool, not just for legal compliance but also for promoting transparent financial systems. Always remember, while taxation might seem cumbersome, with the right documentation, like the PTCL Tax guarantee, and guidance from tax consultancy experts, the path becomes significantly smoother. So, the next time you ponder over your tax affairs, let this guide be your compass. Embrace a world of financial transparency and ease!