The Pakistan Software Houses Association for IT and ITES (PASHA) is a vital organization representing Pakistan's IT and IT-enabled Services (ITES) sector. Established in 1992, PASHA has been instrumental in promoting and protecting the interests of the technology industry in Pakistan. Membership in PASHA is highly regarded, providing companies with numerous benefits, including access to resources, networking opportunities, industry insights, and advocacy on policy issues. This guide will walk you through the process of PASHA registration in Pakistan, detailing the steps, requirements, and benefits of becoming a member.

Table Of Content

- Why Join PASHA?

- Eligibility Criteria To Become A Member Of PASHA

- PASHA Membership Categories

- Step-by-Step Guide to PASHA Registration

- Additional Tips

- How We Can Help: Your Trusted Tax Consultancy Partner

Why Join PASHA?

Before diving into the registration process, it's essential to understand why becoming a member of PASHA is beneficial:

Networking and Collaboration: Connect with IT industry leaders, peers, and potential clients through PASHA's extensive network. Participate in industry events, conferences, and workshops to build relationships and exchange knowledge.

Industry Advocacy: PASHA actively represents the IT industry's interests at government and regulatory bodies. Benefit from their efforts to shape policies and create a favorable business environment.

Business Development Support: Access resources and tools to enhance your business development strategies, including market research, lead generation, and export promotion.

Professional Development: Take advantage of training programs, certifications, and skill development opportunities offered by PASHA to enhance your team's capabilities.

Recognition and Branding: Gain visibility and credibility through PASHA's endorsement and promotion of member companies.

Access to Funding and Incentives: Explore opportunities for funding, grants, and incentives available to PASHA members.

Eligibility Criteria To Become A Member Of PASHA

To become a member of P@SHA, a company must meet specific eligibility criteria:

- Registered Entity: The company must be legally registered in Pakistan under the relevant laws and regulations.

- Nature of Business: he primary business should be in the IT or ITES sector, including software development, IT consultancy, BPO, KPO, or other related services.

- Operational History: The company should have a proven track record of operations, typically requiring at least one year of business activity.

- Financial Standing: The company should demonstrate financial stability and a good credit history.

- Commitment to Industry Standards: The company must adhere to industry best practices and standards, ensuring quality service delivery.

PASHA Membership Categories

PASHA offers different membership categories to accommodate the diverse needs of IT companies:

- Ordinary Membership: Suitable for software houses with annual IT revenue between PKR 5 million and PKR 50 million.

- Associate Membership: For companies providing support services to the IT industry (e.g., hardware vendors, telecom providers).

- Corporate Membership: Designed for large IT companies with annual IT revenue exceeding PKR 50 million.

- Startup Membership: For newly established IT startups.

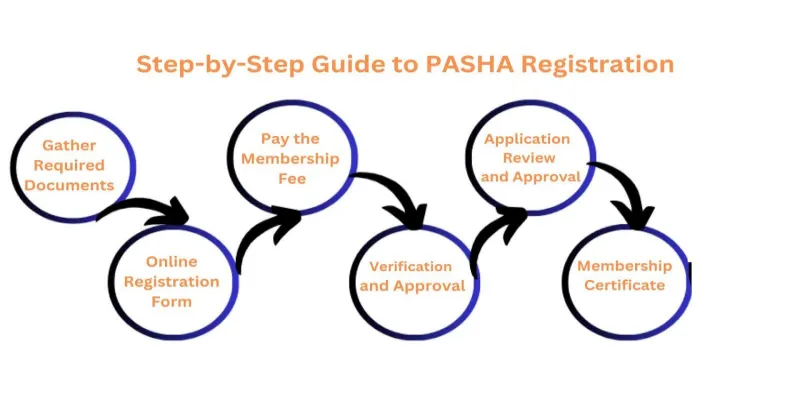

Step-by-Step Guide to PASHA Registration

1. Gather Required Documents

The first step in the registration process is to gather the necessary documents. These typically include:

- Company Registration Certificate: Proof that your company is registered with the Securities and Exchange Commission of Pakistan (SECP) or relevant provincial authorities.

- National Tax Number (NTN): Your company's NTN issued by the Federal Board of Revenue (FBR).

- Audited Financial Statements: Financial statements for the last fiscal year, audited by a recognized firm.

- Company Profile: A detailed company profile highlighting your business activities, services, clientele, and achievements.

- Directors' CNICs: Copies of the Computerized National Identity Cards (CNICs) of the company's directors.

- Bank Account Details: Information about your company's bank account, including the account number and branch details.

2. Complete the Online Registration Form

P@SHA has streamlined the registration process by offering an online application form available on their official website. Here's how to complete it:

- Visit the P@SHA Website: Navigate to the official P@SHA website (www.pasha.org.pk).

- Access the Membership Section: Click on the 'Membership' tab and select 'Join PASHA.'

- Fill Out the Form: Provide accurate and detailed information in the form, including your company's name, registration number, address, contact details, and business nature.

- Upload Documents: Upload the required documents as specified in the form. Ensure all files are in the correct format and size.

- Review and Submit: Carefully review the information provided before submitting the form. Any discrepancies or incomplete information may delay the process.

3. Pay the Membership Fee

After submitting the online form, you will be required to pay the membership fee. The fee structure varies depending on the size and turnover of the company. Generally, it includes:

- Small Enterprises: Companies with less than 50 employees or a lower annual turnover are charged a nominal fee.

- Medium Enterprises: Companies with 50-200 employees or a moderate annual turnover have a slightly higher fee.

- Large Enterprises: Companies with more than 200 employees or a significant annual turnover are charged the highest fee.

Payment can be made through various methods, including bank transfer, online payment, or cheque. Ensure that you retain the payment receipt for future reference.

4. Verification and Approval

Once your application and payment are submitted, PASHA will conduct a verification process. This involves:

- Document Verification: PASHA will review the submitted documents to ensure they meet the eligibility criteria.

- Background Check: A background check may be conducted to verify the company's operational history, financial standing, and adherence to industry standards.

- Interview (if required): In some cases, PASHA may request an interview with the company's directors to better understand their business.

The verification process typically takes a few weeks. Upon successful verification, you will receive an approval notification via email.

Step 5: Application Review and Approval

Once you've submitted your application and payment, the P@SHA membership committee will review your submission. This process may take a few weeks, depending on the volume of applications. If additional information or clarification is required, P@SHA will contact you.

Step 6: Receive Your Membership Certificate

Upon approval, you'll receive a membership certificate from P@SHA, officially recognizing your company as a member. You'll also gain access to the members-only section of the P@SHA website, where you can explore exclusive resources and opp

Additional Tips

- Thoroughly Review Membership Benefits: Understand the benefits offered by different membership categories to choose the most suitable option for your company.

- Prepare Required Documentation: Gather all necessary documents in advance to streamline the registration process.

- Attend PASHA Events: Actively participate in PASHA events and networking opportunities to maximize the benefits of membership.

- Stay Updated: Keep yourself informed about PASHA initiatives, industry trends, and government policies through PASHA's communication channels.

By becoming a PASHA member, your software house can gain a competitive advantage, access valuable resources, and contribute to the growth of Pakistan's IT industry.

How We Can Help: Your Trusted Tax Consultancy Partner

We specialize in supporting IT companies like yours. We offer comprehensive services including expert guidance through PASHA registration, strategic tax planning to optimize your financial position, efficient tax return preparation, robust representation during tax audits, and in-depth financial advisory. By partnering with us, you can focus on growing your business while we handle the complexities of taxation, ensuring your financial health and compliance. Contact TaxConsultancy today to learn more about how we can support your business through every stage of growth and ensure your financial health is always in top form.