In Pakistan, precise import-export documentation is the backbone of trade, vital for both clearance and compliance. Every trader, from corporate magnates to SME owners, must align with these protocols. Our guide explains the maze of paperwork integral to Pakistan’s trade framework, spotlighting crucial steps and common blunders to sidestep. At TaxConsultancy, we unpack the essentials, ensuring your documents are error-free and your business thrives. Stay tuned for a seamless trade journey, right here in the heart of Pakistan's marketplaces.

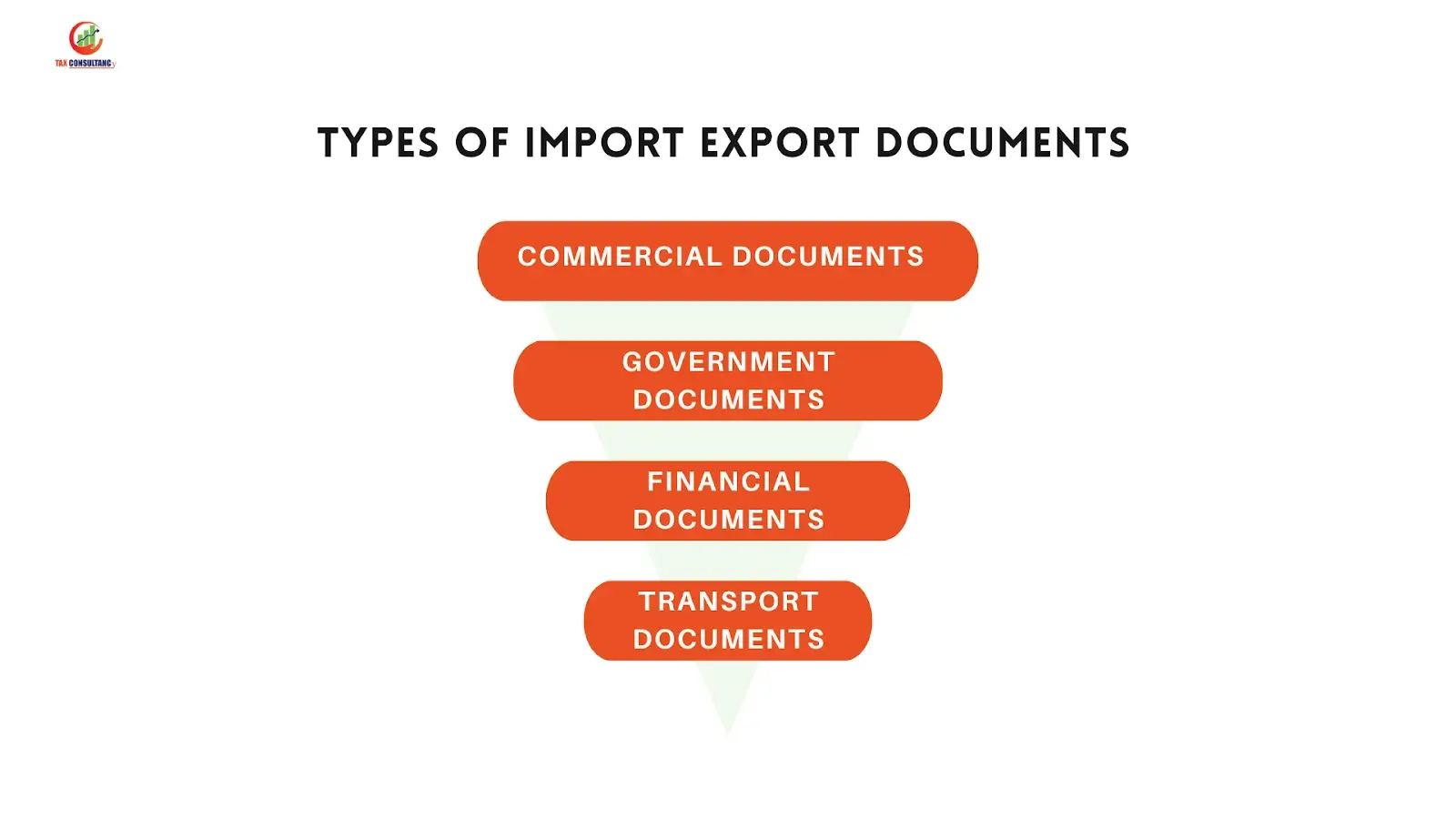

Types Of Import Export Documentst

In the bustling trade corridors of Pakistan, mastering the documentation flow is vital. Here's a primer on the types of documents you'll encounter:

1. Commercial Documents:

Commercial documents are essentially the paperwork that Pakistani traders create and exchange to record the details of a trade transaction. They serve as a written record of the agreement between buyer and seller and are vital for both legal and logistical purposes. Here's a simple breakdown:

- Quotation: This is where the seller outlines the price and terms of what they're selling. Think of it as a formal offer to sell goods at specific prices and under certain conditions.

- Sales Contract: This document is like a promise between the buyer and seller. It's a detailed plan that says, "We agree to trade under these rules and prices."

- Pro Forma Invoice: It's like a preview of the bill that will come later. It tells the buyer what to expect in terms of what's being sent and how much it might cost.

- Packing List: This tells everyone what's in the boxes – how much there is, how it's packed, and other important details about the goods being shipped.

- Commercial Invoice: The actual bill that the seller sends to the buyer. It lists the goods, how much they cost, and how the buyer should pay.

- Certificates: These could be many different documents that prove the goods are okay to sell, like making sure they are as described, insured, healthy to use, and packed properly.

These documents make sure that everyone involved knows what's supposed to happen, what the goods are, and how much they're worth, making the whole buying and selling process clear and official. It's like having a checklist for trade – making sure all is well and everyone's on the same page, protecting the interests of Pakistani businesses in the trade game.

2. Government Documents

Government documents in the context of Pakistan's import and export business are official papers that either require governmental approval or are issued by government agencies. They serve as a formal bridge between trade entities and regulatory authorities, ensuring compliance with national laws and international trade regulations. Here’s an easy explanation:

- NTN (National Tax Number): This is like your business's identity card for tax purposes. You get it from the tax department.

- Sales Tax Registration: If you're bringing goods into Pakistan, you need this registration to show you're ready to handle sales tax.

- Chamber of Commerce Membership: This certificate from your local Chamber shows you're a recognised player in the business community.

- Import and Export License: Usually, you don't need these in Pakistan. But for some goods, you'll need this special permission to trade.

- Import Export Declaration: This is like informing the customs officers about what you're bringing in or taking out of the country, so everything is clear and legal.

- Certificate of Origin: It's a document that vouches for where your goods were made. It's needed to confirm that the products are genuinely from Pakistan.

These documents are key to making sure that your trade activities align with the rules and contribute to the economy without any legal forms. They’re not just formalities; they help smooth the path for goods to move across borders by providing necessary information to the relevant authorities, checking Gst number & ensuring everything is up to snuff from a legal standpoint.

3. Financial Documents

Financial documents in the realm of Pakistan’s import-export landscape are the nuts and bolts that keep the financial gears of trade turning smoothly. Here’s a simple breakdown:

- Bank Account: This is the primary pot where all your trade-related transactions take place, both for paying and getting paid.

- Documentary Credit: Imagine this as a promise note from the buyer's bank to the seller, assuring that the payment will be made once the trade conditions are met.

- Bill of Exchange: This is like a written nudge from the seller to the buyer, stating that the buyer owes them a certain amount for the goods received.

- Promissory Note: Quite similar to an IOU, where the buyer promises to pay the seller directly, without involving others.

- Letter of Credit: This is a heavyweight in trade finance – a secure guarantee from a buyer's bank to the seller’s bank, ensuring payment upon fulfilling the trade agreement.

- Form E: Exclusive to Pakistan, this form is a declaration for the exports, a must-have for Pakistani exporters to comply with foreign exchange regulations.

In essence, these documents are crucial in ensuring that money changes hands in a secure, capital gain tax , reflecting the trust and credibility in international trade transactions. They form the financial backbone of trade agreements, guaranteeing that sellers receive their dues and buyers get their money’s worth, keeping the trade wheels greased and the commerce engine running without a hitch.

4. Transport Documents

Transport documents serve as the navigational charts in the steps of international trade, ensuring the smooth transit of goods from Pakistan’s bustling ports to global destinations. Here's a user-friendly explanation:

- Shipping Order: Consider this as the captain’s orders for the cargo ship. It lists what’s to be loaded on board, charting out specifics like voyage details and cargo descriptions.

- Bill of Lading (B/L): This is the VIP pass for your goods on a vessel. It's a legal document issued by a carrier to acknowledge receipt of cargo for shipment.

- Air Waybill (AWB): The air cousin of the B/L, this paper trail is essential for goods travelling by plane, detailing the journey from Pakistani skies to foreign airfields.

- Packing List or Packing Note: Think of it as the detailed packing guide for your shipment, laying out everything from weights and measures to the contents of each box or pallet.

Together, these documents are international logistics, coordinating the maze of export and import to ensure that every package reaches its curtain call at the right stage & Ntn number. They’re the unsung heroes behind the scenes, making global trade perform seamlessly.

Checklist For Import & Export Documents In Pakistan

Embarking on international trade? Here's your essential checklist for import and export documents in Pakistan to ensure a smooth and compliant trading journey.

Import Documents Checklist

| Document Type | Description |

|---|---|

| Commercial Invoice | A detailed bill from the seller to the buyer, providing information about the transaction. |

| Bill of Lading (B/L) or Air Waybill (AWB) | A contract between the owner of the goods and the carrier. For sea and air shipments respectively. |

| Packing List | Details every item in the shipment, its weight, and how it’s packed. |

| Certificate of Origin | A declaration of where the goods were manufactured, usually issued by the Chamber of Commerce. |

| Import General Manifest (IGM) | Filed with customs before the arrival of the goods, listing all the details of the shipment. |

| Insurance Certificate | Proof that the goods are insured under a policy during transit. |

| Sales Tax Registration | The importer's registration with the Federal Board of Revenue for tax purposes. |

| NTN (National Tax Number) | The importer's tax identification number in Pakistan. |

| Bank Payment Receipt | Proof of payment for the goods being imported. |

| Regulatory Certificates | Any additional certificates required by Pakistani law for specific goods (like health or safety certificates). |

Export Documents Checklist

| Document Type | Description |

|---|---|

| Pro Forma Invoice | An initial invoice sent to buyers, describing the products and the terms of the transaction. |

| Commercial Invoice | The final bill is exchanged by the exporter and buyer, detailing the transaction and terms of sale. |

| Bill of Lading (B/L) or Air Waybill (AWB) | For sea and air shipments, serving as a receipt for the goods and outlining the carriage contract |

| Packing List | An itemised detail of the shipment's contents, dimensions, and weight. |

| Certificate of Origin | This certifies the country in which the goods were produced. |

| Export Licence | If required, depending on the nature of the goods being exported. |

| Sales Tax Deregistration | Evidence that the goods are de-registered from local sales tax, if applicable. |

| Form E | A form required by the Pakistani bank to declare the export and enable foreign exchange transactions. |

| Insurance Certificate | Assures that the shipment is insured against loss or damage. |

| Quality and Inspection Certificates | If required by the importing country or buyer, certifying the goods meet certain standards. |

When engaging in trade, having this checklist at the ready ensures a watertight process,reducing spaces that could cause delays or additional costs. Keep in mind, requirements can evolve; so it's smart to confirm the latest regulations with the relevant Pakistani authorities or a seasoned trade consultant.

Sum Up!

To wrap it up, keeping a keen eye on your import and export documents in Pakistan is crucial. It’s all about ticking the right boxes to ensure your goods move smoothly and legally. From the moment you draft a commercial invoice to the point where you hand over the transport documents, every step matters. Remember, the right paperwork is your ticket to a hassle-free trade journey. So, double-check your documents, stay updated with the regulations, and you'll be set to take your business to the next level!

FAQs

1. Do I need a specific licence to import goods into Pakistan?

In most cases, no specific import licence is needed in Pakistan. However, sales tax registration is mandatory and serves as an import licence. But keep an eye out – certain products may require special permissions.

2. What’s the first step in starting an export business in Pakistan?

First off, snag yourself a National Tax Number (NTN) and register for sales tax. Next, get your company listed with the relevant Chamber of Commerce and Industry. Now you’re ready to rock the export scene!

3. How important is the Certificate of Origin in export documents?

It's super important! This document proves your goods were made in Pakistan, which can be a golden ticket for trade agreements and customs perks.

4. Can I export goods without a Form E in Pakistan?

Nope, that’s a no-go. Form E is like your product’s passport for leaving the country, stamped by the bank to say you’re all clear for takeoff.

5. What’s a Commercial Invoice and why do I need it?

Think of the Commercial Invoice as the all-telling story of your transaction. It’s got all the juicy details: what you’re selling, how much it’s going for, and the terms of payment. It's a must-have for getting paid and clearing customs.

6. Is a Bill of Lading only used for sea freight?

Right on the money. It’s the VIP pass for your goods on their sea voyage, a contract with the shipping line that your items are on board.